Quantifying delivered carbon removal as a buyer of early technologies

September 19, 2022|Joanna Klitzke, Zeke Hausfather, Nan Ransohoff

September 19, 2022|Joanna Klitzke, Zeke Hausfather, Nan Ransohoff

At Frontier, our north star is the development of high-quality, low-cost carbon removal solutions that can collectively scale to the 6 billion tons required annually by 2050. One key feature of quality, as described in our target purchase criteria, is the ability to confidently quantify the carbon that has actually been removed. As a buyer, we want to know that one ton of removal purchased has resulted in one ton of carbon removed from the atmosphere or ocean.

This piece first describes the challenges and uncertainties we face as an early buyer in quantifying carbon removal deliveries in a nascent field. We then suggest a framework to make it actionable for buyers–including Frontier itself. Our hope is that this helps buyers more confidently make purchasing decisions from a range of carbon removal pathways–particularly from promising early solutions that are harder to quantify.

For Frontier and other early buyers, quantification is not an abstract challenge. In the absence of well-established measurement frameworks and protocols, we grapple with questions like:

Today, we and other buyers invest in thorough project-level diligence and bespoke verification of outcomes to answer these questions. As the market scales, and purchase volumes increase, we will need to move to a more systematic and standardized approach.

We partnered with CarbonPlan to map confidence and uncertainty associated with quantifying carbon removals for six pathways within our portfolio: biomass carbon removal and storage, direct air capture, enhanced weathering, ocean alkalinity enhancement, and terrestrial and ocean biomass sinking. You can see the results of that work here.

The purpose of this piece is to operationalize that analysis as an early buyer by:

There are few formal protocols developed for quantifying how much carbon was actually removed, and while permanent carbon removal largely avoids the problems of additionality and durability that plague traditional offsets, there are still major uncertainties associated with quantifying the tons removed across a diverse set of early-stage projects.

Many carbon removal approaches involve complex interactions with their surrounding environments, making binary and deterministic calculations challenging. This is especially true of open systems (e.g., enhanced rock weathering or ocean alkalinity enhancement) versus closed systems (e.g., direct air capture). Even if a project executes perfectly, it can still be hard to confidently assess how much carbon was permanently removed. It’s more accurate to think in probabilities: how likely is it that the action taken resulted in the amount of removal intended?

Quantification certainty varies by pathway (e.g., DAC vs ocean alkalinity enhancement), approach within that pathway (e.g., electrochemical OAE vs mineral addition OAE) and supplier execution (e.g., sampling density or modeling method). To break down differences in quantification uncertainty across pathways, we partnered with CarbonPlan to develop an interactive Quantification Tool that explores the important components of each carbon removal pathway and characterizes the type and impact of each uncertainty.

Not unlike with cost curves for early technologies, it’s both possible and likely that there is substantial room to improve our confidence in quantifying carbon removal and durability outcomes. It’s critical for buyers to consider the future slope of an uncertainty curve, in addition to where the solution is today.

While we should strive to reduce uncertainty as much as possible, 100% certainty isn’t a feasible end goal for all approaches–especially open-system pathways with complex interaction effects. As buyers, we’ll need to consider quantification uncertainty as one of many factors such as cost, ecosystem safety and potential for scale. For example, it’s possible that some open-system approaches ‘max out’ at medium quantification certainty, but are extremely cheap and have nearer-term potential for gigaton-scale removal. From a climate perspective, it’s better to remove 10,000 tons with 60% confidence than to remove 1,000 tons with 90% confidence. It’s plausible buyers decide to purchase large quantities of removal from solutions where near-term potential for scale is high but quantification certainty is low as part of a broader portfolio after considering pros and cons holistically.

How can buyers overcome these challenges? This section outlines five recommendations for buyers that we at Frontier will be incorporating into our own purchasing strategy and decision making, starting with the Fall 2022 purchase cycle.

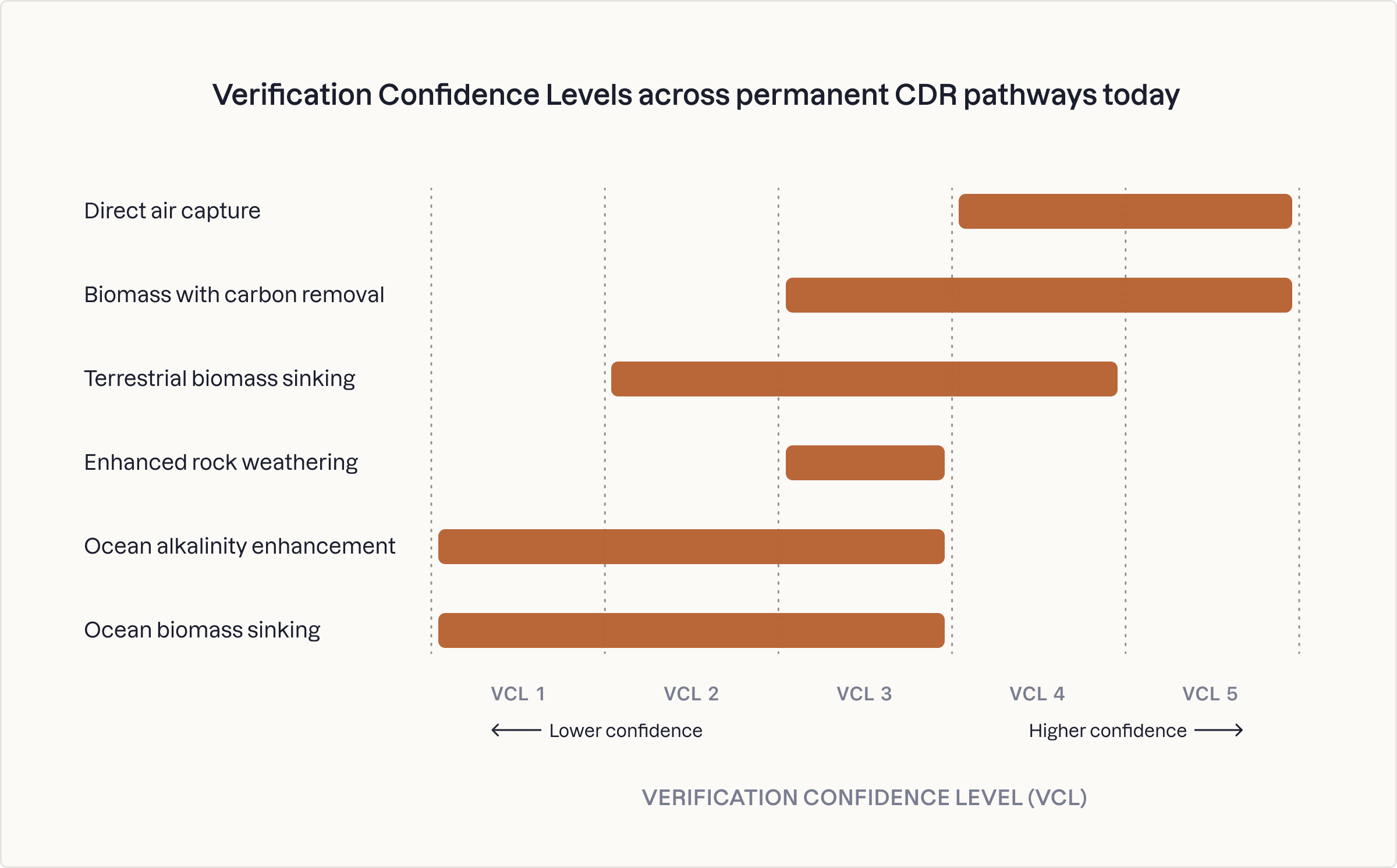

To aid our own process at Frontier, we developed Verification Confidence Levels (VCLs) to make quantifying uncertainty more easily actionable for buyers. VCLs are a directional metric that represent how confident we are that carbon removal and durability outcomes can be accurately quantified for each pathway, using the best available science, instrumentation, modeling and methodologies available today. They are based on the combined uncertainty across all the quantification components we identified, and intended to help buyers understand current certainty ranges for various carbon removal pathways.

See detailed descriptions of each VCL here. Note: This chart excludes other criteria critical to evaluating the promise of CDR pathways, like potential for scale.

As we’ve seen, the range of VCLs across carbon removal pathways and suppliers is wide (and this snapshot doesn’t even include all possible pathways). As buyers who want to get carbon removal on its best possible trajectory, a question we wrestle with is: what needs to be true about verification confidence for us to buy at larger volumes?

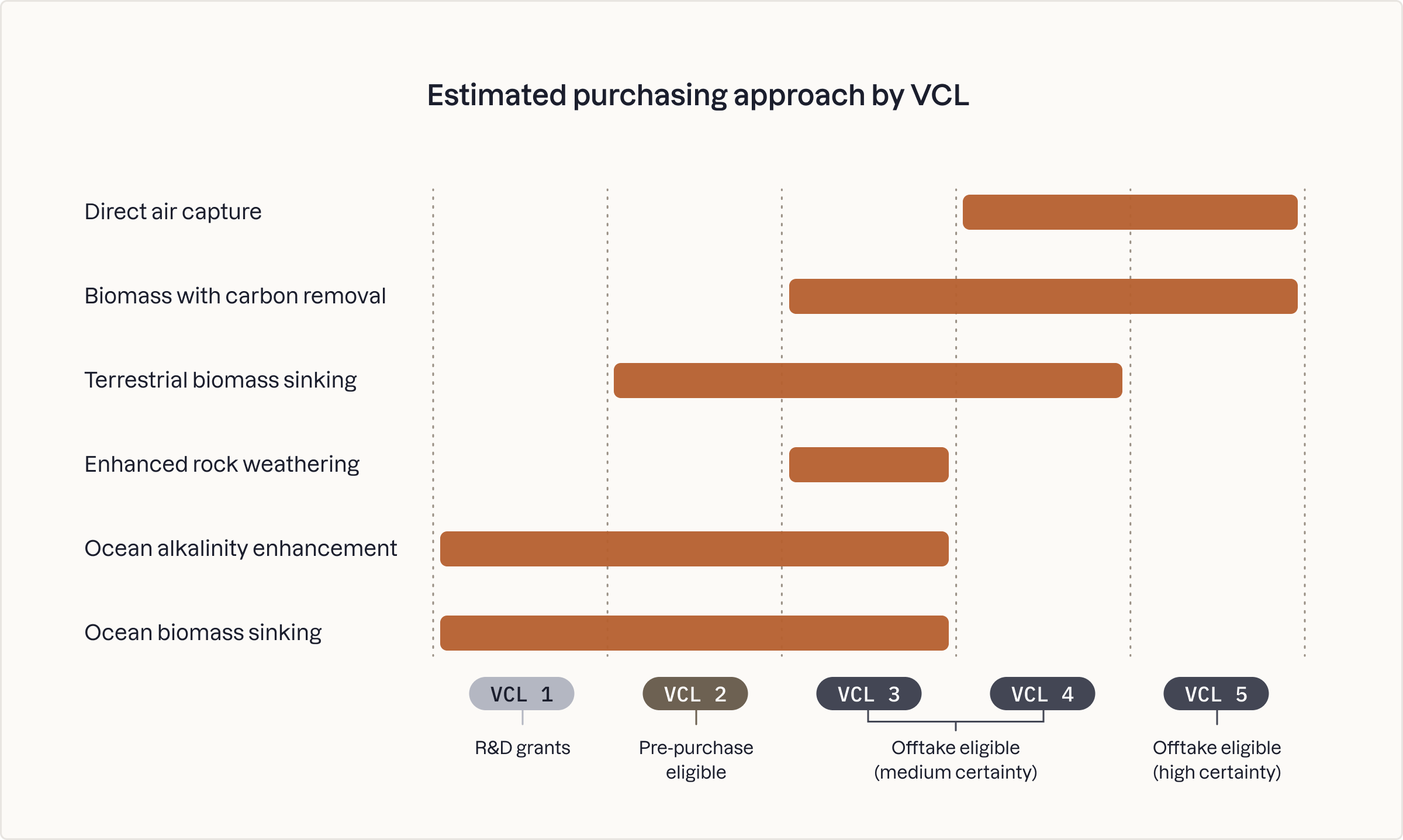

In the most general sense, as our purchases get bigger, we want to have greater confidence in how much carbon we removed. For smaller purchases, we’re more tolerant of uncertainty.

For low-VCL approaches, grant funding and small pre-purchases can be a catalytic way to support the exploration of promising new solutions with the potential for scale. The benefit to buyers of purchasing from low-VCL approaches is the acceleration of promising new solutions and the generation of valuable data from early deployments, rather than receiving tons or credits in return.

While the cutoff point for expecting tons back is inescapably subjective, we think that cutoff is roughly around VCL 2 or 3. A VCL 1 pathway, for example, may be a better fit for a research grant. For VCL 3 and beyond, larger purchases are reasonable (of course, quantification is merely one of many important factors in evaluating a purchase).

The bottom line is that when making larger purchases, we want to have high confidence in carbon removal delivered. Buying at larger quantities doesn’t require all uncertainties to be resolved. But uncertainties do need to be characterized well enough so that we can discount them accordingly. In short, our ability to more confidently quantify outcomes should be a precondition to larger purchases, but shouldn’t stage-gate supporting early-stage innovation.

Discounting is a concept commonly used by many sectors to deal with uncertainty. In the case of carbon removal, we propose that buyers can systematically incorporate uncertainty into purchasing by asking suppliers to apply an uncertainty discount to tons:

Delivered tons = Net tons * (1-Uncertainty discount)

More uncertainty means a bigger discount on tons, reducing the net tons removed and effectively increasing the price per ton. In short, higher uncertainty should increase the price of a ton. And inversely, reducing uncertainty should also reduce price.

Cost per delivered ton = Cost per net ton * Net tons / Delivered tons

How should we calculate this uncertainty discount for a given project? Conceptually, the uncertainty discount is a function of both project-level uncertainty and system-level uncertainty that are described in detail for six pathways in the interactive tool we built with CarbonPlan. At Frontier, we’ll be asking projects to estimate each uncertainty component in their pathway as part of our purchasing diligence. But this is admittedly a high-effort stop-gap. Eventually, uncertainty discounting should be directly included in MRV protocols developed and then verified by credible third parties.

When we say high scale carbon removal at low cost, that’s inclusive of the cost of measurement and the relevant uncertainty discounts. But today, the cost of quantifying carbon removal–collecting field samples, developing models, or monitoring deployments–is blended together with infrastructure, energy and material costs and buried within the price per ton.

We’d like to see suppliers break out quantification costs and third party verification and registry fees alongside operational expenditures and capital expenditures within their proposals. It may initially be costly to remove tons through direct air capture but cheap to measure, for example, while enhanced weathering has low underlying costs but costs more to measure with high confidence. Buyers should see–and pay for–the realistic, holistic cost of carbon removal, which includes both doing the removal and quantifying and monitoring that the tons were permanently removed.

It’s worth highlighting that, perhaps counterintuitively, the cost of measurement could be lower at high VCLs. At higher VCLs where we understand the system and margins of error are constrained, we can draw conclusions over larger volumes with fewer measurements and do not need to sample every ocean biomass buoy or basalt application. At VCL 1 and 2, measurement and monitoring should be especially rigorous as we get our arms around uncertainties by generating more field data and studies.

Only if the costs associated with MRV (which will vary significantly by pathway) are clearly visible can we push to drive measurement accuracy up and costs down, alongside core technology cost reduction.

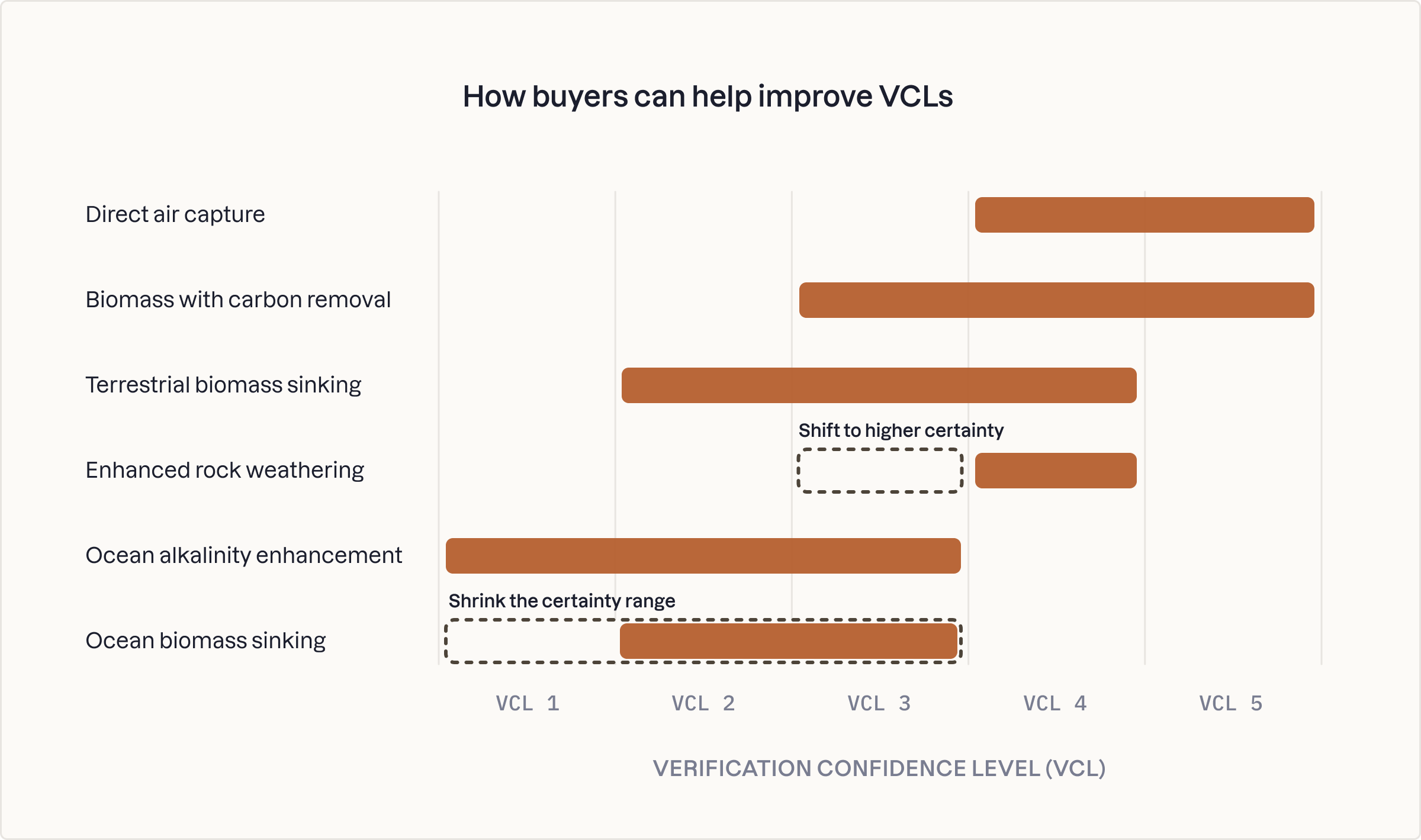

As buyers we can help improve VCLs by purchasing from suppliers that will increase the VCL for their pathway or shrink the VCL range.

This could look like purchasing from an ocean alkalinity enhancement company that is actively developing better bicarbonate sensors that could increase the pathway’s VCL. Or, buying from an enhanced weathering company that is conducting novel trials to refine the field’s estimation of leakage (this hypothetical example assumes that ecosystem, safety and community questions have been sufficiently addressed).

Buyers can further support the reduction of pathway uncertainties by building milestone payments into purchase contracts from companies that are pioneering innovative quantification improvements or field-MRV contributions.

The Quantification Tool and proposed framework we’ve laid out are an imperfect starting point to help us and other early buyers think about our role in pushing toward a lower cost, higher volume, and lower uncertainty carbon removal system.

To reach permanent carbon removal at scale, we recognize that we need to build not only a lot of physical infrastructure—steel in the ground, renewable capacity, stacks of bipolar membranes—but also a broader ecosystem architecture that includes a robust measurement and verification system.

We do not have the perfect vision of this architecture, but hope it includes:

We look forward to working with other buyers, carbon removal providers, academics, philanthropies, and nonprofits to help build a robust system for permanent carbon removal MRV.

A huge thank you to CarbonPlan and everyone involved in building the Quantification Tool, our design and engineering team for bringing this work to life, and Hannah Bebbington, Rafael Broze, Stacy Kauk, Cara Maesano, Florian Maganza, Peter Minor, Ryan Orbuch, Peter Reinhardt, John Sanchez, Matt Schmitt, Benjamin Tincq, Max Tuttman, Freddie Williams, Adam Wolf, and Mary Yap for the critical feedback that shaped this article. We look forward to continuing the conversation.